The Department of Health and Human Services officially approved the Market Stabilization rule as part of the Patient Protection and Affordable Care Act (ACA) on April 18, 2017. This rule amends the ACA and takes effect June 19, 2017. Unlike the AHCA, this is not a full bill that repeals and replaces ACA; instead, it adds to the existing bill. Written with the intention to reduce fraud and abuse within the individual market, a few new regulations surrounding annual open enrollment period (OEP) and special enrollment periods (SEPs) have been added to the current ACA.

Who is affected?

This rule affects the individual and small group markets. If you and your family purchase your own insurance through a carrier or through the Marketplace, then take note of the adjustments produced by this rule.

If you own a small business, then your health insurance selection process is also affected by this rule.

What is changing?

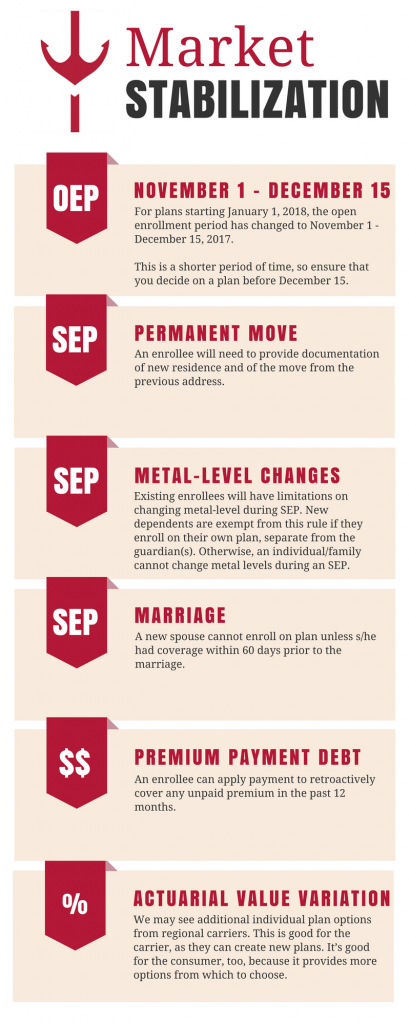

November 1st through December 15th will be when you are allowed to either change or purchase insurance for January of 2018. Only individuals with a valid SEP reason will be allowed to purchase a new policy outside of this time period.

Some individuals are able to enroll in a new plan outside of OEP if they have a major life event that qualifies them for a SEP. For more information on what is categorized as a qualifying life event, check out the official list from healthcare.gov here.

The regulations regarding purchase of health insurance during an SEP include:

- Any clients new to the Marketplace will have to be pre-verified before they can purchase coverage.

- Existing enrollees will have limitations on changing metal-level during SEP. New dependents are exempt from this rule if they enroll on their own plan, separate from the guardian(s). Otherwise, an individual/family cannot change metal levels during an SEP.

- Extra information will be collected on SEP enrollees for any termination due to nonpayment of a previous policy.

- “Marriage” SEP: A new spouse cannot enroll on plan unless s/he had coverage within 60 days prior to the marriage. This prohibits an individual from extending his/her 60-day SEP via marriage.

- “Permanent Move” SEP: An enrollee will have to provide documentation of new residence and of the move from the previous address.

In addition to changes in verification for SEP enrollments, a couple of other updates have been made to the ACA, including:

- Premium payment debt can now be paid. An enrollee can apply payment to retroactively cover any unpaid premium in the past 12 months.

- Actuarial Value Variation will expand. As a result of this variation for 2018 plans, we may see health plans providing more plan options. We may see additional individual plan options from regional carriers. This is good for the carrier, as they can create new plans. It’s good for the consumer, too, because it provides more options from which to choose.

Questions about this rule?

Questions about this rule?

If you have questions about these changes and how they may affect you, your family, or your business, you can call us at (412) 261-1842. You can also direct questions to our health insurance experts via email to [email protected].

Additional Reading:

Special Enrollment Period Qualifying Events (healthcare.gov)

Essential Community Providers (CMS FAQ)

Please note that the information contained in this posting is designed to provide authoritative and accurate information, in regard to the subject matter covered. However, it is not provided as legal or tax advice and no representation is made as to the sufficiency for your specific company’s needs. This post should be reviewed by your legal counsel or tax consultant before use.