“I owe how much?”

Recently, our customer, Julie, was surprised to learn that a simple procedure she had scheduled with her dermatologist cost her $930 out of pocket. “‘They had sent me some paperwork in the mail prior to the procedure that stated, according to my health care coverage and high deductible plan; I was going to owe that amount up front.”

Julie’s situation is more common in recent years due to the adoption of high deductible plans and HSAs (Health Savings Account) available through employers and the marketplace. High deductible plans do offer many advantages and are generally more affordable than traditional styles of coverage, but when consumers receive covered services they often face significant out-of-pocket costs.

It was only after visiting the doctor’s office and paying the $930 did she learn the importance of comparing the medical bill to her Explanation of Benefits (EOB).

“After talking to some friends in the healthcare industry, I learned that I should take the time to compare the amount I paid with the Explanation of Benefits (…) The total was only $750 (on the EOB), and I had already paid the dermatologist the $930 (medical bill). I picked up the phone and asked the receptionist (…); she confirmed that I was overcharged and she was able to credit my bank account that same day.”

It was Julie’s follow-up that put $180 back in her pocket!

So like Julie, if you have been asked to pay upfront for a procedure, you can use your EOB to see if you were billed the correct amount. If you are not billed correctly, don’t hesitate to ask your doctor to return any overpayments.

What is an Explanation of Benefits?

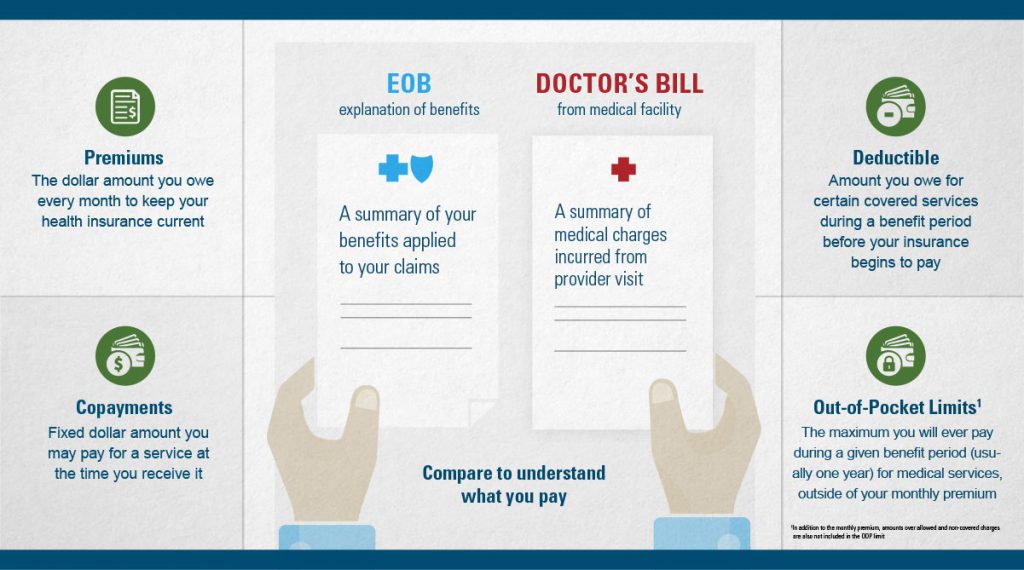

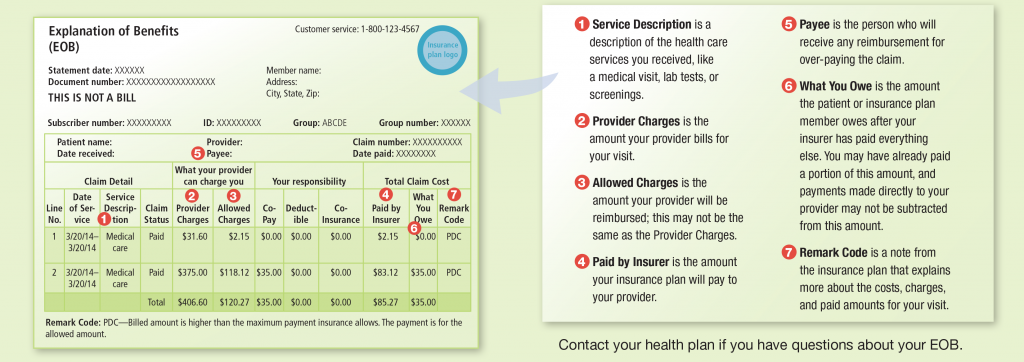

Your EOB is a statement that shows what health services you received, what bills your health plan paid, and what you may still owe to a health care provider. It is not a bill. The EOB will also inform you about your status in regard to your annual deductible and out of pocket maximums.

This document is often found online through a plan’s online member portal.

Sections of an EOB

- Service Description is a description of the health care services you received, like a medical visit, lab tests, or screenings.

- Provider Charges is the amount your provider bills for your visit.

- Allowed Charges is the amount your provider will be reimbursed; this may not be the same as the Provider Charges.

- Paid by Insurer is the amount your insurance plan will pay to your provider.

- Payee is the person who will receive any reimbursement for over-paying the claim.

- What You Owe is the amount the patient or insurance plan member owes after your insurer has paid everything else. You may have already paid a portion of this amount, and payments made directly to your provider may not be subtracted from this amount.

- Remark Code is a note from the insurance plan that explains more about the costs, charges, and paid amounts for your visit.

Sources:

CMS.gov Health Insurance Marketplace Outreach and Education

Blue Cross Blue Shield of North Carolina: Helping you with insurance claims so you can get on with your life

TUFTS Health Plan: How to Read Your Explanation of Benefits (EOB)

Please note that the information contained in this posting is designed to provide authoritative and accurate information, in regard to the subject matter covered. However, it is not provided as legal or tax advice and no representation is made as to the sufficiency for your specific company’s needs. This post should be reviewed by your legal counsel or tax consultant before use.