Hello, meet Mike. Mike is the sole provider for his family. He supports his wife, Jane, and two children, James and Ava. He has a great job at Acme Corporation, but like many people, he struggles to pay for more than providing the basic necessities. He depends highly on his paycheck week in and week out. Without that source of income, he would not have enough funds to pay for basic living expenses.

There are many sources of stress in people’s lives. Financial stability HAS PROVEN TO BE THE source of the greatest anxiety in people’s daily lives. It is no wonder why Mike like many others worry about circumstances where time-off from work would impair their ability to provide for their families. Disability insurance is a solution that many employers are providing to protect their employees’ lifestyle in the event of unplanned time off work.

Statistics show 40% of U.S. adults don’t have the money on hand to cover a $400 emergency, and the average savings account balance is just over $11,000.* Without the financial safety net that disability insurance provides by protecting an employee’s paycheck, many of your employees will not have the ability to meet their basic financial needs – like groceries, rent, and daily expenses.

We know that you go to great lengths to ensure your employees are happy and healthy. They are the lifeblood of your business and will ensure the longevity of your enterprise. Offering an employer-sponsored disability plan is a great step to protecting your employees’ paycheck when they are unable to work.

When was the last time that you reviewed your disability plan designs and contract provisions? Too often many employers miss the value in this program and do not take the time to ensure it is structured correctly. A program that misses the mark may result in unsatisfied employees and possibly misappropriated corporate assets.

The status quo response is not a winning strategy, especially in this competitive job market. You must design a disability plan that compliments your other benefits and corporate culture to attract and retain top talent.

So how can we accomplish this? Designing a best in class plan design examines all aspect of your policy. This doesn’t have to be a daunting task. Here are three basic steps to follow and contract provisions to review:

- Include all sources of an employee’s income

- Definition of Earnings: Earnings definition should reflect an employee’s total compensation. Insurance carriers offer multiple options to make sure that all an employee’s earnings are covered. Be sure to choose the definition that accurately reflects how the employee is compensated. Most common definitions include salary only, prior year W-2 earnings, or salary plus commissions, overtime, bonuses, etc

- Design plans customized to meet the needs of your workforce demographics

- Elimination Period: This refers to the period that an employee must be unable to work before benefits are paid. Does your company allow or require an employee to use PTO or exhaust their sick time before filing a claim? Making sure that your contract reflects these corporate policies is essential to make sure your benefits are doing what they are designed to do.

- Ensure the benefit amount is enough to meet the needs of your employees in the event they are unable to work?

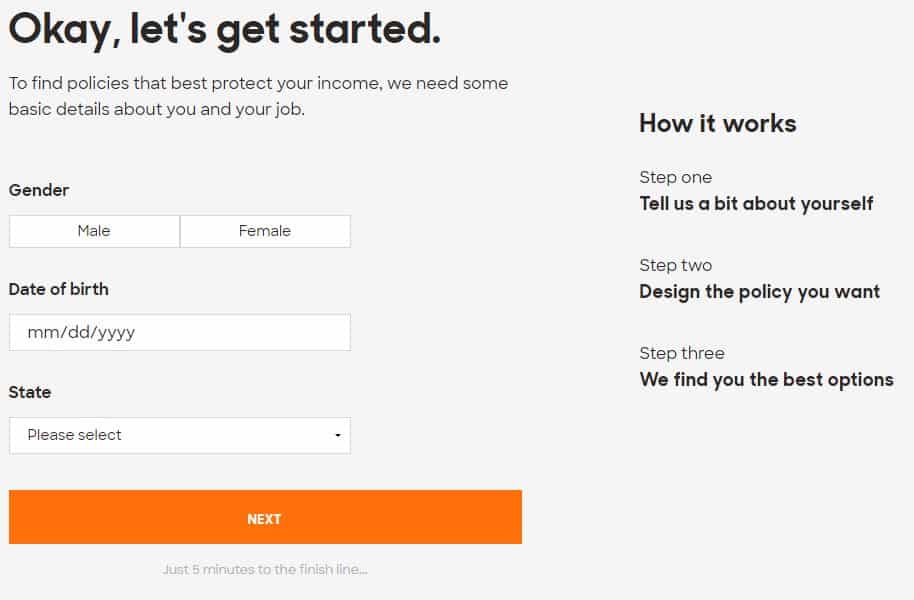

- Benefit Maximums: Are you providing adequate paycheck protection while your employee is unable to work? A standard policy has a 60% replacement percentage. Click the link to an online disability benefits calculator and look at a few classes of your workforce (executives, management, and all others) to see an estimated take-home monthly disability benefit. If this number exceeds your benefit maximum in your contract, then you might want to increase the number. Conversely, if the max is too high then you can look to reduce it to a more appropriate amount.

Pro Tip: Including tools like this calculator will help increase employee engagement as well as bolster the value of your disability program.

So, how does your group disability program measure up?

These programs can be tailored to meet the unique needs of your workforce. Showing that you care for your employees while they recover from a sickness or injury is crucial to deepening the employer-employee relationship. Making sure your plans are properly designed ensures the benefit is aligning with corporate policies.

Henderson Brothers has the tools and resources to help design a best-in-class disability program. Please reach out to Scott Martinelli for a free consultation.

Please note that the information contained in this posting is designed to provide authoritative and accurate information, in regard to the subject matter covered. However, it is not provided as legal or tax advice and no representation is made as to the sufficiency for your specific company’s needs. This post should be reviewed by your legal counsel or tax consultant before use.