It is that time of year again for plan sponsors to begin preparing their Medicare Part D notices. Employers with group health plans that provide prescription drug benefits must notify Medicare Part D eligible individuals by October 15th whether the group prescription coverage is at least as good as Medicare Part D coverage. Coverage that meets the Medicare Part D standard is considered “creditable”.

Why is this important?

Medicare Beneficiaries who are not covered by creditable prescription coverage and who choose not to enroll in Medicare Part D before the end of their initial enrollment period will likely pay higher premiums if they remain on the group plan and enroll in Medicare Part D at a later date. While there are no specific penalties associated with this notice requirement, employers that fail to provide the disclosure may trigger adverse employee relations issues.

Who is required to comply with the Medicare Part D Disclosure Requirements?

Generally, any employer-sponsored group health plans offering prescription drug coverage to individuals who are eligible for coverage under Medicare Part D must comply with the disclosure mandate. This means plan sponsors of all sizes should be prepared to comply.

Who is Medicare Part D eligible?

- An individual who is entitled to Medicare Part A and/or enrolled in Part B; and

- Who resides in the service area of a prescription drug plan (PDP) or a Medicare Advantage plan that provides prescription drug coverage (MA-PD).

In general, an individual becomes entitled to Medicare Part A when the person actually has Part A coverage, and not just when the person is first eligible.

Why must plan sponsors tell Part D eligible individuals whether their prescription drug coverage is creditable?

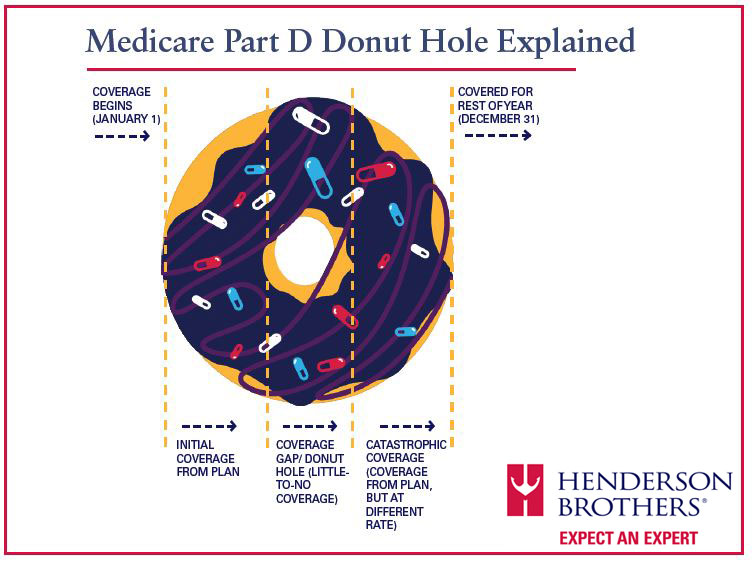

Plan sponsors must tell Part D eligible individuals whether their prescription drug coverage is creditable so that the Medicare eligible individuals can compare their existing coverage with the coverage provided under a Part D plan in time for the Medicare Annual Open Enrollment Period. Part D eligible individuals who are not covered under creditable prescription drug coverage will be told they may be subject to a permanent late enrollment penalty in the form of higher premiums in the event that they choose to enroll in Part D coverage at any time after the end of their Initial Enrollment Period.

Should I send this form to COBRA participants?

Yes, they are to be treated like any other active participant with respect to this notice requirement.

Where do I get a form to start this process?

Every year HBI provides a Compliance Update on this requirement along with sample model notice forms you can use to meet your disclosure requirement. Our benefit experts can help you determine if your plan is creditable or non-creditable and can provide assistance on customizing the notice for your particular company and prescription plan. Our model forms are in Word format so they can be modified easily.

Is there a reporting requirement that goes along with this Medicare Part D Notice Obligation?

Yes, Plan sponsors must also remember to notify the Centers for Medicare & Medicaid Services (CMS) each year, no later than 60 days from the beginning of the plan year whether the coverage is creditable. The CMS Creditable Coverage Disclosure website is available here.

Note: If prescription benefits change on a date outside the Plan Year that impact the creditability of the coverage, or prescription coverage is terminated entirely, the plan sponsor must disclose the change to CMS within 30 days of the change.

Where do I get information about whether I can disclose this information electronically instead of mailing the forms to participants?

Plan sponsors are permitted to send the forms via email or post the forms to a company internet site instead of mailing paper copies to participant homes; however, the DOL Electronic Disclosure Safe Harbor regulations should be followed. Employers that have not adopted the Safe Harbor approach yet can reach out to their HBI Benefits Analyst or Consultant for details on this process.