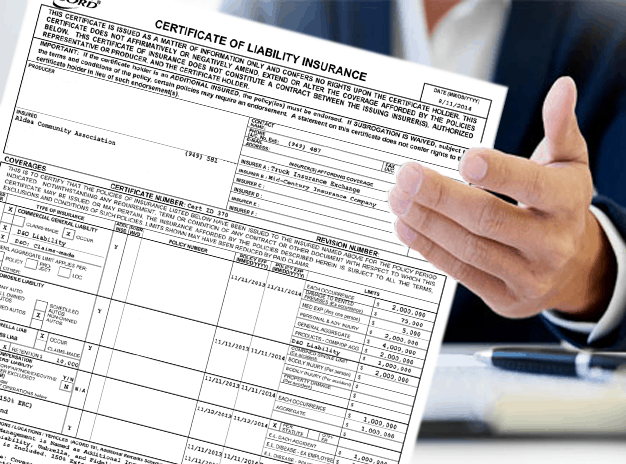

Insurance is an important component of many business transactions. Whether you’re a construction company hiring subcontractors, a manufacturer contracting with a supplier for component parts, or anything in between, you require proof that the other party carries adequate insurance to protect them and you in the event of a claim. This proof is provided in the form of a certificate of insurance.

However, if you’re not familiar with the standard ACORD 25 certificate of insurance, it can be difficult to determine whether the documents you receive comply with the requirements of your subcontract agreement or purchase agreement.

The following are some tips to help you review certificates of insurance:

- Confirm that the Insured listed at the top of the certificate matches your subcontractor’s or supplier’s name.

- Ensure that your company is listed as the Certificate Holder in the box at the bottom left of the certificate.

- Check the Description of Operations box for a project name or number, purchase agreement number, or other descriptor, if applicable.

- Compare the types and limits of insurance evidenced on the certificate to those required by your contract. The four policies listed on a standard certificate are Commercial General Liability, Auto Liability, Umbrella or Excess Liability, and Workers Compensation/Employer’s Liability. The certificate also has space for additional coverages, such as Pollution Liability or Professional Liability, if required. Verify that for each policy, an insurance carrier, policy number, and valid effective and expiration dates are listed on the certificate.

- Verify that the required additional insured status and waivers of subrogation are indicated, if required by your contract. For each policy, there are boxes labeled “Addl Insd” and “Subr Wvd.” If you have requested to be included as an additional insured or to have subrogation waived, the appropriate box for that policy should be marked. The Description of Operations box or an attached Notes page should also include language that explains the endorsements and coverage provisions that apply; confirm that these fulfill the requirements of your contract.

Remember that a certificate of insurance is just a proof of the coverage the insured company currently carries. The certificate doesn’t amend coverage or provide coverage to the certificate holder. For this reason, you should also ask for copies of relevant endorsements (additional insured, waiver of subrogation, etc.) along with the certificate. Reviewing the endorsements will help you confirm that the provisions and protections required by your contract will extend to your company.

If you have questions about the types and limits of insurance you should require from your subcontractors or suppliers, or if you need assistance reviewing the certificates you receive, your Henderson Brothers team is here to help.

Please note that the information contained in this posting is designed to provide authoritative and accurate information, in regard to the subject matter covered. However, it is not provided as legal or tax advice and no representation is made as to the sufficiency for your specific company’s needs. This post should be reviewed by your legal counsel or tax consultant before use.