By Chris Shipley, Vice President and Director of Emerging Markets

I would bet that I see at least 2-3 articles a week about the strength of the economy and how it is creating a difficult job market for attracting and retaining quality employees. Additionally, I probably talk to at least one business each week that laments about how difficult it is to “find good people.” I am sure this is a conversation that you have had internally or with a vendor of yours. It is no secret that companies are impacted by this issue each day. The war on talent is real.

What I have found, though, is that companies who look beyond starting salaries, regular breaks and paid time off and take a strategic approach to their benefits package, even going so far as to begin to view their benefits package as a total rewards platform, are best positioned to win the war.

The Industry Landscape

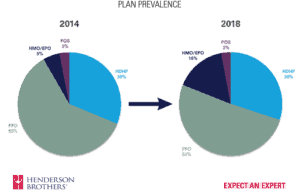

In the Benefits Consulting industry, we are seeing a shift in the way that companies are assembling their total rewards platform. In preparation for a presentation that I recently made on Benefits Trends and Benchmarking, I was researching the most common types of medical plans offered to employees. Utilizing the Milliman 2018 National Benchmarking Survey, I was able to see that 51% of employers currently offer a traditional PPO plan while 30% now offer a High Deductible Health Plan (HDHP). I was curious, however, about how the plan design offerings have shifted over the last five years, so I went back and looked at the 2014 Milliman Survey results, expecting that the most significant growth would be in HDHP plans. The results, to say the least, was surprising. The biggest jump in plan designs offered in the last five years was not in HDHP plans but in HMO/EPO plans, which operate like traditional PPO plans but have a more limited network of participating providers. These plans represented 5% of companies in 2014 and 16% of companies in 2018.

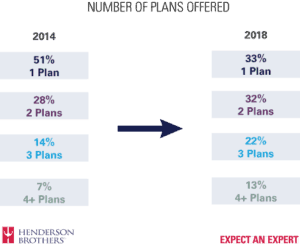

Furthermore, when you look at the total number of medical plans that companies are offering to their employees, employers that offer only one medical plan dropped from 51% in 2014 to 33% in 2018. Coincidentally, employers that currently provide three plans jumped from 14% in 2014 up to 22% in 2018 and employers that now offer four or more plans jumped from 7% in 2014 to 13% in 2018. While this may seem like a bunch of insignificant statistics, this tells me two critical things about the state of employee benefits and medical plan offerings:

The State of Employee Benefits Health Plans

The State of Employee Benefits Health Plans

First, employers have started to shift their benefit programs to appeal across a broader base of employees. Employees want choice. In many cases, you are probably buying too much insurance for your employees and paying more money than you need to for those rich medical plans. Employees are willing to shop for their care and will travel a little further or change providers to save money.

Second, the health insurance delivery model is changing and evolving rapidly. Employers have squeezed every dollar out of deductible and copay changes to control costs. Milliman, in the same benchmarking report cited earlier, also found that 40% of employees will gladly trade a broad network of providers to save money in their paycheck. Health insurance carriers have already begun to respond to this market condition as we have seen a considerable shift in the number of carriers offering more narrow network products to appeal to a broader base of employees while also doing everything possible to optimize network performance and control costs. Furthermore, carriers have found that by raising the bar for provider performance, their networks perform more efficiently and cost-effectively. At the same time, employees are willing to forego a network that has every provider for a network with fewer, but more cost-effective providers, if it saves them money too. We’re also seeing a change in the delivery model around telemedicine. Telemedicine has provided a cost-effective option for routine medical care while increasing access.

We have also begun to see more and more employers offer benefits that appeal to an employee’s “lifestyle.” For the first time ever, there are five generations of employees in the workforce. They all have varying needs when it comes to medical insurance, and they expect you, the employer, to meet those needs by offering a variety of benefits plans and options. The days of employers providing one medical plan, one dental plan, some vision coverage and $100,000 in group term life insurance may soon come to an end. As the pressure mounts on talent recruitment and benefits, you, the employer, need to think more than ever about what you’re offering to get employees to come work for you and what you are doing to keep them working for you.

Building A Total Rewards Program To Win The War On Talent

Therefore, the best strategic consideration is to implement multiple benefit options that increase the value of an employees’ total rewards program. A recent BenefitFocus study found that 73% of employees agree that having customized benefits to meet their needs would increase their loyalty to that employer and a staggering 94% of employees want employers to ensure their benefits offering has a meaningful impact on their quality of life. One way to accomplish that objective is to consider expanding the benefits offering to include more “non-traditional” benefits available for employees to purchase.

As more and more employers realize that Generations X, Y & Z now make up the majority of their workforce, traditional product offerings are shifting. Employees in these generations will spend money and buy products that make sense to them. For instance, we have seen an enormous uptick in employers offering Identity Theft coverage for their employees. This benefit provides a financial sense of security to employers, particularly Millennials whose online presence create vulnerability. Employers offering this coverage has increased by 56% in the past two years. Another “perk” that we expect to continue to rise in popularity over the next 2 to 3 years are student loan reimbursement programs. This benefit has shown to increase loyalty to employers while providing employees assistance with crushing student debt.

We’ve also seen an increase in the number of employers offering employees support concerning Medicare. A recent Bureau of Labor Statistics study found that every 8.5 seconds for the next 11 years a Baby Boomer turns 65. Employers who offer education and consulting around Medicare enrollment can provide their employee with a sense of security and understanding during a very confusing time while also reducing potential risk on their plans. Finally, as more and more states begin to legislate around paid leave, employers are responding by putting in their own paid leave programs to provide financial assistance during a qualifying leave.

In the 2018 Milliman National Benchmarking survey, for the first time in several years, attracting and retaining employees was ranked higher than controlling cost. While the Employee Benefits market consistently evolves and adapts to market pressures, an employer that prioritizes the changing needs of their workforce, optimizing their benefits package to be cost-effective and attractive, will be best positioned to win the war on talent.

Henderson Brothers has the tools and resources to help design a best-in-class employee benefits program. Please reach out to Chris Shipley for more details.

Please note that the information contained in this posting is designed to provide authoritative and accurate information, in regard to the subject matter covered. However, it is not provided as legal or tax advice and no representation is made as to the sufficiency for your specific company’s needs. This post should be reviewed by your legal counsel or tax consultant before use.