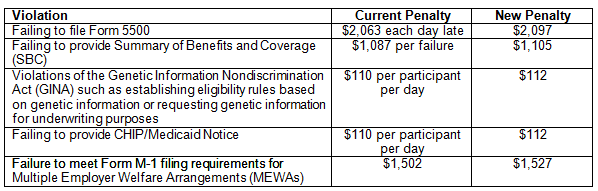

In January of this year the DOL issued its first annual adjustment of civil penalties for several benefit-related violations. The new penalties are effective for penalties assessed after January 13, 2017 for violations occurring after November 2, 2015. We have included a chart below that summarizes the changes.

If you have any questions regarding the information summarized above, or need us to help you update your health plan’s required disclosures, including the SBC and CHIP notice, please reach out to your HBI analyst or consultant directly. We are here to help you with all your reporting and disclosure obligations.

For a PDF version of this update, click here.

Please note that the information contained in this document is designed to provide authoritative and accurate information, in regard to the subject matter covered. However, it is not provided as legal or tax advice and no representation is made as to the sufficiency for your specific company’s needs. This document should be reviewed by your legal counsel or tax consultant before use.